2023 Guide to Medicare Part B

Are you overwhelmed and confused with questions about Medicare? Let us help! In this article we are breaking down what Medicare Part B is and what it does for you.

Medicare Part B is a government-funded program that provides a range of health care coverage for people over the age of 65 and those with certain disabilities. You can expect coverage for doctors’ visits and preventative care, just to name a few. It’s important to understand what Medicare Part B is and how it works to make the most of your coverage. So, let’s dive in!

Coverage under Medicare Part B?

Doctor Visits: Medicare Part B helps cover the cost of visits to a doctor or other healthcare provider. This includes visits to a primary care doctor, specialist, or mental health provider.

Outpatient Care: Medicare Part B helps cover the cost of treatments and tests performed in an outpatient setting. For example, a hospital or clinic. This includes services such as radiation therapy, physical and occupational therapy, and laboratory tests.

Preventive Services: Medicare Part B helps cover the cost of preventive services, such as cancer screenings and vaccinations.

Medical Equipment and Supplies: Medicare Part B helps cover the cost of certain medical equipment and supplies, such as wheelchairs, walkers, and home oxygen.

Prescription Drugs: Medicare Part B does not cover the cost of prescription drugs, but it does cover certain medications, such as certain injectable drugs, drugs used in clinical trials, and certain vaccines.

Mental Health Services: Medicare Part B helps cover the cost of mental health services, including visits to a psychologist or psychiatrist.

What is not covered?

Medicare Part B does not cover most long–term care services, such as custodial care in a nursing home, assisted living facility, or adult day care center. It also does not cover most dental services, routine foot care, hearing aids, eyeglasses, or cosmetic surgery. It also does not cover most prescription drugs, over–the–counter medications, or medical supplies such as bandages and gauze. In addition, Medicare Part B does not cover acupuncture, chiropractic care, or long–term care insurance premiums.

Who is eligible?

Medicare Part B is available to individuals who are 65 years of age or older, individuals with certain disabilities, and individuals with End–Stage Renal Disease (ESRD).

How much does it cost?

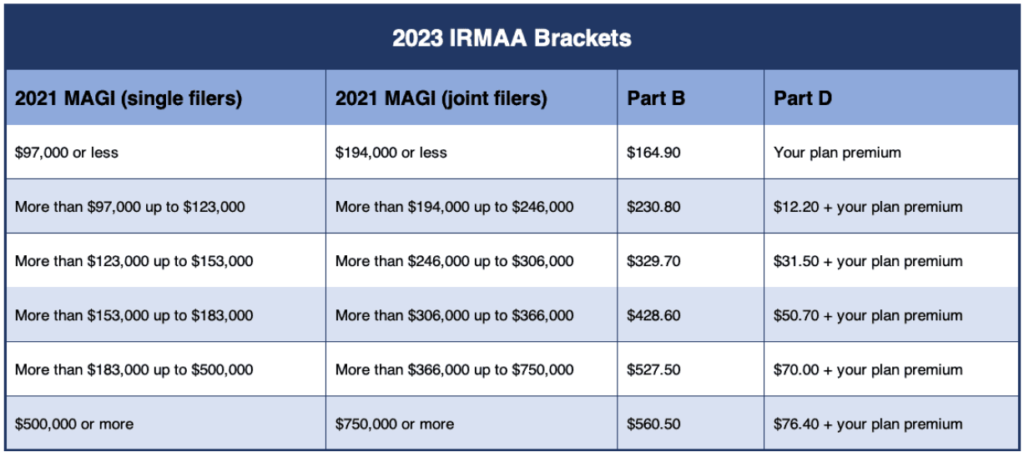

In general, the Part B premium in 2023 will be $164.50 per month. However, those with higher incomes may pay more. This is due to IRMAA. IRMAA stands for Income-Related Monthly Adjustment Amount. This is a Medicare premium surcharge paid by certain Medicare beneficiaries. IRMAA is a premium adjustment based on a beneficiary’s modified adjusted gross income (MAGI) reported on their federal tax return from two years prior.

Cost Sharing with Medicare Part B

Part B requires cost-sharing, which is the amount the beneficiary pays for covered services. For 2023, the deductible is $226. Deductibles must be met prior to Medicare paying their portion. After that, Part B pays 80% of the Medicare-approved amount for covered services. The beneficiary will pay the remaining 20% with no cap.

How to apply and when to enroll?

Applying for Medicare can seem daunting, but it doesn’t have to be. With the right information and guidance, you can easily apply for Medicare. As stated above, most individuals will enroll and apply for these benefits during their Initial Enrollment Period. If you are applying for these benefits, you can do so by completing an application online, by phone, or by mail.

Individuals already collecting Social Security benefits will be automatically enrolled. In the event you are not collecting those benefits, you will need to enroll yourself. This is done during your Initial Enrollment Period. There is a 7-month window to enroll during this period. It begins three months before you turn 65, the month you turn 65 and ends tree months after you turn 65.

In the event you did not enroll during the Initial Enrollment Period, you would need to enroll during the General Enrollment Period. This period runs form January 1st through March 31st. Please note, if you did not have credible coverage, you may be subject to a penalty when you enroll called the Medicare Part B Late Enrollment Penalty.

What is the Medicare Part B Late Enrollment Penalty?

When you’re first eligible for Part B, you have a 7-month window to sign up, as explained above. If you don’t sign up during this Initial Enrollment Period, you could be subject to a late enrollment penalty.

The late enrollment penalty will cause a 10% increase in your monthly premium for every 12-months you go without coverage. So, the longer you wait, the higher the penalty. In some cases, you may be exempt from the late enrollment penalty. This includes situations where you had coverage from an employer or union, or if you had a Medicare Advantage Plan and then switched back to Original Medicare.

It’s important to remember that the late enrollment penalty doesn’t apply to Part A of Medicare, which covers hospital care.

If you’re eligible for Part B of Medicare, it’s best to sign up during the initial enrollment period. That way, you can avoid the late enrollment penalty and make sure you have the coverage you need.

Conclusion

Medicare Part B is an important component to your Medicare coverage. It helps millions of Americans pay for their health care services and supplies. It is important for individuals to understand the coverage that is provided with Part B, so that they can make the best decisions for their health care needs. While Medicare Part B does not cover everything, it does provide a tremendous amount of coverage that can help individuals and their families stay healthy and financially secure. With the right information and understanding of the program, Medicare Part B can be a great resource for health care coverage.