Costs for Inpatient Hospital Admission : Supplement vs Advantage

Navigating hospital costs with Medicare can be a daunting task, especially when faced with the complexity of choosing between different coverage options. Understanding your costs for inpatient hospital is crucial for making informed decisions about your healthcare.

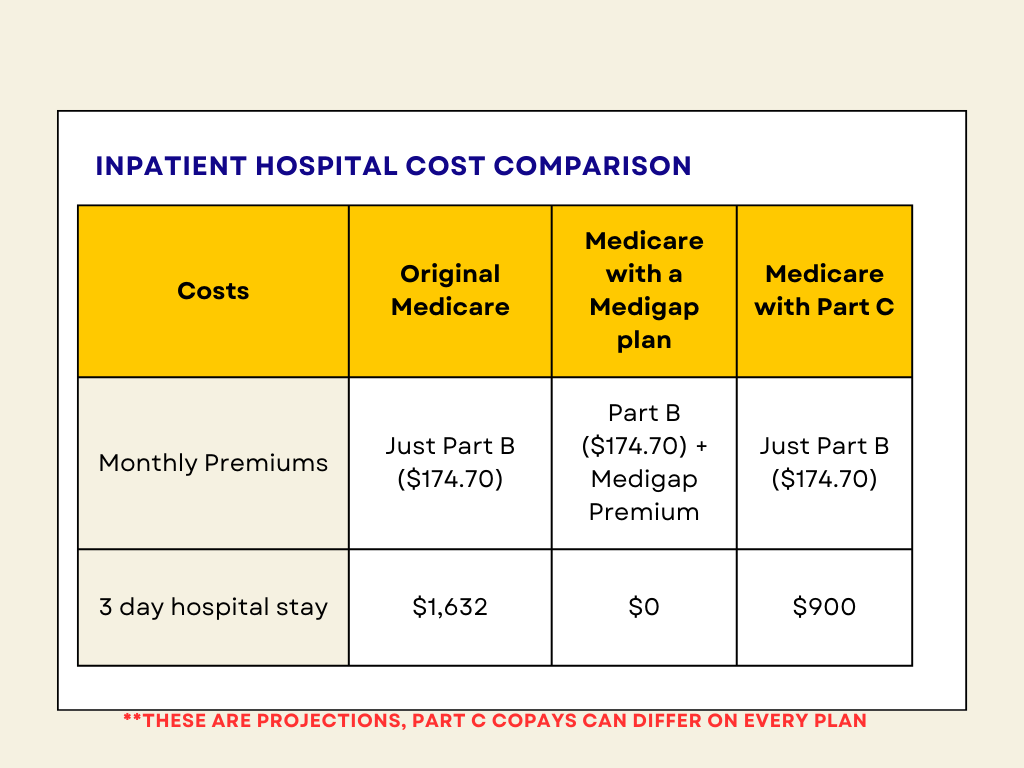

In this article, we’ll explore the financial implications of hospital expenses under three distinct scenarios: relying solely on original Medicare, enhancing original Medicare with a Medigap Plan G, or opting for Medicare coverage through a Part C Advantage Plan. By examining each option in detail, we aim to provide you with the knowledge needed to navigate the intricacies of healthcare costs and choose the best plan for your needs without breaking the bank. From deductibles to copayments, we’ll break down the potential expenses associated with each scenario, empowering you to make confident decisions about your healthcare coverage. So, let’s delve into the world of Medicare and hospital costs to uncover the differences and similarities among these three coverage options.

Inpatient Hospital Costs Under Original Medicare

When it comes to figuring out the costs of staying in a hospital under original Medicare in 2024, there’s a bit of a process. First off, there’s the deductible, which is like a starting fee you need to pay. In 2024, this deductible is $1,632. Once you’ve paid this amount, Medicare kicks in to help cover the rest of your hospital expenses for the first 60 days of your stay.

Now, let’s say you need to stay in the hospital longer than 60 days. After that 60-day mark, things start to change. From day 61 to day 90, there’s a copay you have to pay for each day you’re in the hospital. This copay is $408 per day. Then, if you end up needing to stay even longer, from day 91 to day 150, the copay increases to $816 per day.

So, let’s break it down. If you’re in the hospital for just a few days, you’ll start by paying the deductible of $1,632. Medicare will cover the rest of the costs for those first 60 days. But if you stay longer, you’ll start paying copays after day 60. These copays can add up, especially if your stay extends beyond 90 days. It’s important to keep these costs in mind and plan accordingly, especially if you think you might need a longer hospital stay.

- Days 1-60: $0 after you pay your Part A deductible ($1,632).

- Days 61-90: $408 copayment each day.

- Days 91-150: $816 copayment each day while using your 60

- After day 150: You pay all costs.

The most important thing to remember is, the first 60 days are all covered after you pay your Part A deductible. So whether you are in the hospital for 3 days, or for 30 days, it would be the exact same cost.

Total cost for a 3 day hospital stay: $1,632

Inpatient Hospital Costs with Medicare and Medigap

Now, let’s explore how the costs of inpatient hospital stays would differ for someone with a “Medigap Plan G” as their supplement to Medicare. This plan is designed to help cover the gaps left by original Medicare, including deductibles and copayments.

With a Medigap Plan G, the $1,632 deductible for Part A coverage (which includes inpatient hospital stays) is taken care of. This means that the individual wouldn’t have to pay this deductible out of pocket; instead, the Medigap Plan G would cover it.

As for the copays for days 61 through 150 of an inpatient hospital stay, a Medigap Plan G would also step in to help. The copay for days 61 through 90, which is $408 per day under original Medicare, would be covered by the Medigap Plan G. Similarly, the copay for days 91 through 150, which is $816 per day under original Medicare, would also be covered by the Medigap Plan G.

Essentially, with a Medigap Plan G, individuals can enjoy the peace of mind knowing that both the deductible and copayments associated with extended hospital stays are covered. This can provide financial relief and security, allowing individuals to focus on their health without worrying about hefty out-of-pocket expenses.

Total cost for a 3 day hospital stay: $0

Costs under Medicare Part C for Hospitalazation

Let’s delve into the costs of a three-day hospital stay under Medicare Part C, also known as Medicare Advantage. Unlike original Medicare, Medicare Advantage plans are offered by private insurance companies approved by Medicare. These plans must cover all services that original Medicare covers, but they can do so with different costs and rules.

Under Medicare Part C, the costs for a hospital stay can vary depending on the specific plan a person chooses. Typically, Medicare Advantage plans have their own set of rules, including copayments for hospital stays. Let’s assume that the daily hospital copay under a particular Part C plan is around $300 per day.

For a three-day hospital stay, this would mean the individual would pay $300 per day for each day of their stay. So, for three days, the total out-of-pocket cost for the hospital stay would be $900. It’s important to note that this is just an estimate, as actual copayment amounts can vary depending on the specific Medicare Advantage plan.

One of the advantages of Medicare Advantage plans is that they often have out-of-pocket maximums, which can provide financial protection for beneficiaries. Once the out-of-pocket maximum is reached, the plan typically covers all costs for covered services for the rest of the year. However, it’s essential for individuals to carefully review the details of their specific Medicare Advantage plan to understand their copayments, deductibles, and out-of-pocket maximums. By doing so, they can make informed decisions about their healthcare coverage and budget accordingly.

Total cost for a 3 day hospital stay: $900

Comparing your options

In wrapping up, knowing how much hospital visits can cost under Medicare is super important for making smart healthcare choices. Whether you’re sticking with original Medicare or going for a Medicare Advantage plan, there are different expenses to think about.

With original Medicare, you’ve got to keep an eye on deductibles and copayments, especially if you’re in the hospital for a long time. But if you add something like Medigap Plan G to your original Medicare, it can help cover some of those costs, which could be a relief.

Then there’s Medicare Advantage, where you get all your coverage from a private insurance company. This plan might have lower costs overall, but you still need to watch out for copays, especially if you’re in the hospital.

No matter what, it’s all about finding the right fit for your healthcare needs and wallet. Take your time to check out all your options and see what works best for you. And don’t forget to review your plan every year to make sure it still matches up with what you need. With a little know-how, you can stay on top of your healthcare costs and focus on staying healthy.