3 Reasons People Buy Medigap Plans

When people get older, they have to figure out healthcare stuff, especially when it comes to Medicare. Medigap plans are a choice many folks make to help with this. They fill in the gaps left by regular Medicare. This article will talk about why people like Medigap plans. It’s not too complicated; we’ll focus on three main reasons: they help with costs, let you pick your own doctors, and don’t make you get special permission for treatments.

Choosing a Medicare plan can feel like navigating a maze of options, each with its own benefits and limitations. Among the decisions individuals face is whether to enroll in Medicare Part C (also known as Medicare Advantage) or to supplement their original Medicare coverage with a Medigap plan. Part C plans offer all-in-one coverage, combining hospital, medical, and often prescription drug coverage, while Medigap plans fill in the gaps left by traditional Medicare, helping with out-of-pocket costs such as deductibles and copayments. This article explores the considerations individuals must weigh when deciding between Medicare Part C and Medigap plans, focusing on the unique advantages and trade-offs associated with each option. By understanding the factors at play, individuals can make informed decisions that best suit their healthcare needs and preferences.

Reason # 1: Medigap Plans offer Predictable Costs

Medicare can be confusing, especially with how much you have to pay out-of-pocket for things like doctor visits or hospital stays. With Medigap plans, it’s easier to know what you’ll pay each month. You pay a set amount, and then most of your medical costs are covered. This helps you plan your budget better and not worry so much about surprise bills.

Sometimes, Medigap plans also cover things like emergencies if you’re traveling outside the U.S. This is extra helpful because getting sick or hurt away from home can be really scary, but with Medigap, you know you’re covered.

Reason # 2: Medigap Plans have No Networks

Choose Your Own Doctors: Some health plans make you go to certain doctors or hospitals. But with Medigap, you have more freedom. You can see any doctor or specialist who takes Medicare. This means you don’t have to switch doctors if you really like the one you’ve been seeing for years. It’s nice to have that choice, especially when it comes to your health.

Reason # 3: No Prior Authorization Required

Getting permission from your insurance before you can get medical treatment can be a big hassle. But with Medigap, you don’t have to deal with that. You can just go get the care you need without waiting for someone to say it’s okay. This saves time and makes things simpler when you’re not feeling well and just want to get better.

Types of Medigap Plans

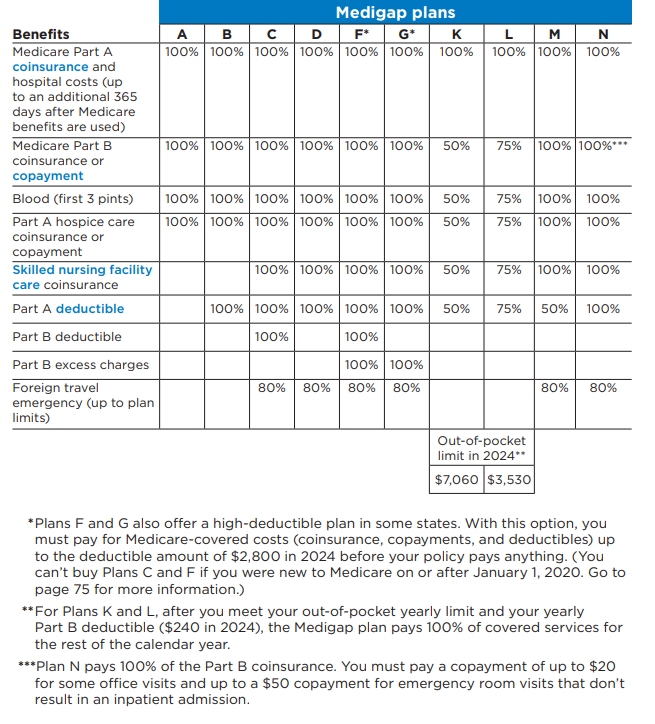

When it comes to purchasing a Medigap plan, also known as Medicare Supplement Insurance, individuals have several options to choose from. These plans are standardized by the federal government, meaning that each plan type offers the same basic benefits, regardless of the insurance company offering it. However, the costs and availability of these plans can vary depending on where you live and the insurance provider.

Medigap plans are labeled with letters from A to N. Each plan offers a different combination of coverage, allowing beneficiaries to select the option that best meets their healthcare needs and budget. Here’s a brief overview of the different types of Medigap plans:

Conclusion:

So, Medigap plans are pretty great for people on Medicare. Since these plans are standardized, be sure to work with a broker so that you know what the best price is in your area. They help make healthcare less confusing and more flexible. With predictable costs, the freedom to choose your own doctors, and no special permissions needed, Medigap plans give you peace of mind and make things easier. If you’re thinking about Medicare, considering these reasons might help you decide if a Medigap plan is right for you.