5 Reasons to choose a Medigap plan in 2024

Healthcare can be pretty confusing, especially when you’re getting older or have certain health conditions. If you’re on Medicare or getting close to that age, you’ve probably heard about something called Medigap plans. But what are they exactly?

Well, Medicare is a program that helps older folks and some people with disabilities pay for medical stuff. It’s great, but it doesn’t cover everything. That’s where Medigap plans come in. They’re like puzzle pieces that fit with Medicare to cover more of your healthcare costs.

In this blog post, we’re going to talk all about Medigap plans and how they work with Medicare. We’ll keep things simple and explain the different types of Medigap plans. By the end, you’ll have a better idea of what Medigap is all about and why it’s important for your healthcare. So, let’s dive in and make Medigap easy to understand!

What are Medigap Plans?

Medigap plans, also known as Medicare Supplement plans, are kind of like extra insurance to help you pay for your healthcare when you have Medicare. You see, Medicare is a government program that helps cover medical costs for people who are 65 or older, or for some younger folks with certain disabilities. But here’s the thing: Medicare doesn’t cover everything. Sometimes, you still have to pay some of the costs yourself.

That’s where Medigap plans come in. They are plans offered by private insurance companies that work together with your regular Medicare (which has two parts: Part A for hospital care and Part B for doctor visits and other medical services). These Medigap plans help you pay for things like deductibles, copayments, and other healthcare expenses that Medicare doesn’t cover completely.

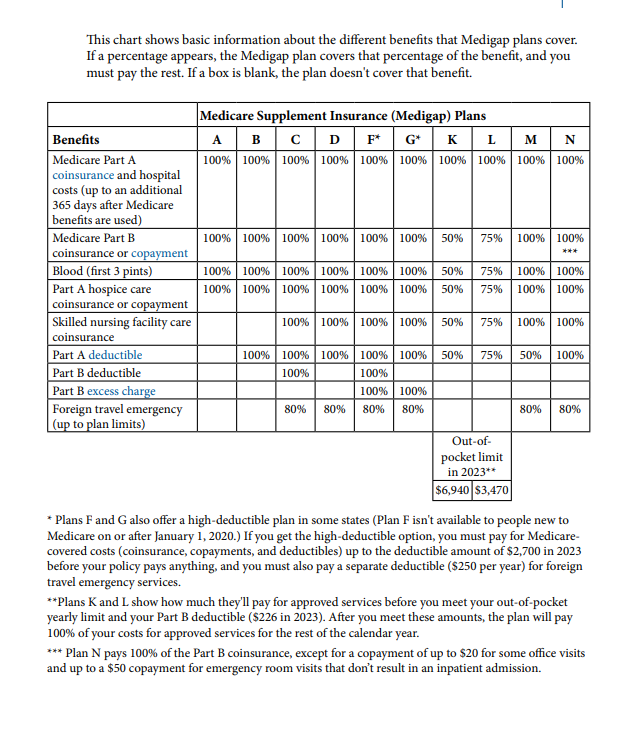

Now, there are different types of Medigap plans, and they are labeled with letters from A to N. Each type of plan offers different benefits. So, you can choose the one that fits your needs the best. It’s important to note that Medigap plans don’t include coverage for prescription drugs, though. If you need help with paying for your medications, you’ll need to sign up for a separate plan called Medicare Part D. So, in a nutshell, Medigap plans help fill in the gaps in your Medicare coverage, making it easier for you to manage your healthcare costs.

Top 5 Reasons to pick Medigap Coverage

1. No Network of Providers

Having a Medigap plan with no network restrictions is vital because it provides unparalleled flexibility and peace of mind in healthcare choices. With no network, you’re not limited to a specific group of doctors, specialists, or hospitals. Instead, you can choose any healthcare provider across the United States that accepts Medicare patients. This freedom is especially valuable if you have existing relationships with particular healthcare professionals or if you require specialized medical care. It ensures that you have the autonomy to make healthcare decisions based on your preferences and medical needs rather than being constrained by network restrictions.

2. Referrals are not required

Not having to get referrals on Medigap plans is a big benefit because it makes getting specialized medical care easier and faster. Normally, when you have a referral requirement, you first have to see your primary care doctor and get their approval before you can see a specialist. This extra step can delay your access to the specialized care you need, especially if you have a health issue that requires quick attention.

Without the need for referrals, you can go directly to a specialist when you have a medical concern. This is particularly important if you have a chronic condition or a health problem that requires specialized expertise. It gives you the freedom to take control of your healthcare and ensures that you can see the right healthcare provider promptly. Ultimately, not having to get referrals in Medigap plans means you have more autonomy and quicker access to the medical care that’s best for you.

3. Plans are Standardized

In the context of Medigap plans, the term “standardized” means that these plans follow a consistent and fixed structure of benefits set by the federal government. When we say that Medigap plans are standardized, it indicates that no matter which insurance company you choose to buy your Medigap policy from, the core benefits of a specific plan type will remain identical. For example, if you decide on Medigap Plan G, the benefits offered by Plan G will be the same, regardless of the insurance company you select. This standardization ensures that consumers can easily compare various Medigap plans and comprehend what they are purchasing, promoting transparency and simplicity when making a choice.

Medigap plans are standardized and offer consistent predictable benefits no matter what insurer you purchase the plan through.

The standardization of Medigap plans is overseen by the government to safeguard Medicare beneficiaries and prevent any confusion. While the fundamental benefits are consistent, the premiums charged by different insurance companies for the same plan may differ. Moreover, certain states have specific regulations regarding Medigap plans, so it’s important to consider local rules when choosing a plan. Standardized Medigap plans provide a clear and predictable set of benefits, making it more straightforward for individuals to make informed decisions about their healthcare coverage.

4. No Prior Authorizations

The importance of Medigap plans not requiring prior authorization lies in the freedom and convenience it offers to Medicare beneficiaries. Prior authorization is a process in healthcare where you need approval from your insurance company before you can receive certain medical services or treatments.

Not having to get permission before getting medical care is a big deal with Medigap plans. It means you can see a doctor or get treatment right away without waiting for your insurance company to say it’s okay.

5. Predictable Costs

Medigap plans have predictable costs because they follow clear and consistent rules. When you choose a specific Medigap plan, like Plan A or Plan F, the benefits it offers are the same no matter which insurance company you pick. This means you can easily understand what you’re getting and how much you’ll pay for certain healthcare services.

Let’s say you have Medigap Plan B. With this plan, you know exactly what it covers, like hospital stays and doctor visits. Since the benefits are standard, you can predict how much you’ll need to pay for these things. Your monthly premium might vary depending on the insurance company, but the coverage stays the same. This predictability is helpful because it allows you to budget for your healthcare costs more easily and avoid unexpected expenses.

Final Thoughts

In conclusion, opting for a Medigap plan offers a range of compelling benefits that can greatly improve your healthcare experience. The freedom to choose healthcare providers without being tied to a specific network, as well as the absence of referrals, means you have more control over your medical decisions. The standardization of Medigap plans simplifies the process of comparing and selecting the right plan for your needs, while the elimination of prior authorization requirements streamlines access to care.

Moreover, the predictability of costs associated with Medigap plans provides financial peace of mind, allowing you to plan your healthcare expenses with confidence. These five key reasons collectively highlight the advantages of Medigap plans, making them a valuable option for Medicare beneficiaries seeking comprehensive coverage and a smoother healthcare journey.