What is Medicare Open Enrollment?

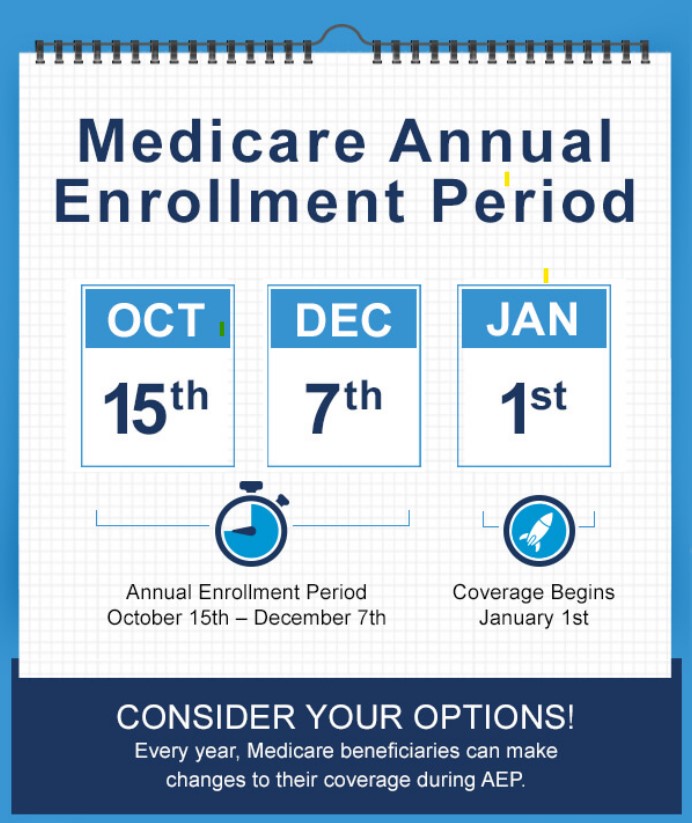

Medicare is a significant healthcare program for people in the United States. Each year there is a special time called “Open enrollment”, also referred to as the Annual Enrollment Period (AEP). This time, which happens from October 15th to December 7th each year, is really important. It allows people with Medicare to think about and change their healthcare plans. This article will help you understand what the Annual Enrollment Period is and why its important.

The Annual Enrollment Period, also known as the Medicare Open Enrollment Period, is when people with Medicare can look at their healthcare plans and make changes . It’s not the same as when you first join Medicare, and it’s different from another time called the Medicare Advantage “Optional Enrollment Period”, which takes place January 1st through March 31st each year.

Why Medicare Open Enrollment Matters:

During the Annual Enrollment Period, you can take time to look closely at your healthcare plan. This is important because your needs and your health might change. This period lets you make sure your plan still works well for you and adjust if not. Medicare Advantage plans change each year. Sometimes the changes are major and others they are very subtle. Regardless, you want to review your plan during this time so you know what changed. If you want to move to a different plan, now would also be the time to do so. Any change made during this period, takes effect January 1st the following year.

You have the chance to switch from one Medicare plan to another during this time. For example, you can go from Original Medicare (Part A and Part B) to a Medicare Advantage plan (Part C), or the other way around. You can also change your prescription drug coverage with Medicare Part D.

By comparing plans during the Annual Enrollment Period, you might be able to save money. You can look at how much you pay for the plan, how much you have to pay before the plan helps cover costs, and how it helps with prescription drugs.

Sometimes, insurance companies offer new plans with better benefits. The Annual Enrollment Period is when you can check out these new options and see if they’re a better fit for you. Since every county has different plans, its easiest to work with a licensed expert to search for different options. Unlike most advisory services, Medicare sales people do not charge a fee for consultations, they are prohibited from charging a fee.

Your Choices During AEP:

Medicare Advantage (Part C): If you have Original Medicare right now, you can change to a Medicare Advantage plan during this time. These plans are from private companies and can give you more benefits like dental, vision, and hearing coverage.

Going Back to Original Medicare: If you’re in a Medicare Advantage plan, you can switch back to Original Medicare (Part A and Part B) if you want. You can also join a separate Medicare Part D plan for prescription drugs if your current plan doesn’t cover them.

Checking Part D Coverage: If you have a Medicare Part D plan just for prescription drugs, you can review it and make changes to make sure it covers your medications.

Any changes made during this time, take effect January 1 the following year!

Tips for the Annual Enrollment Period:

Think About Your Needs: Consider your health and what you need from your healthcare plan. If things have changed, you might want a different plan.

Compare Plans: Use the Medicare Plan Finder tool to see all the plans in your area. Compare how much they cost and what they cover.

Ask for Help: You can talk to experts, like Medicare counselors or insurance agents, to help you understand your choices better.

Don’t Wait: The Annual Enrollment Period doesn’t last long, so start looking at your options early to make sure you don’t miss the deadline on December 7th.

In Summary:

The Annual Enrollment Period for Medicare is an important time to think about your healthcare choices. It’s your chance to review your plan, switch to a different one if needed, and save money. You can change from one plan to another, or even try a new type of plan. Just remember to take your time, compare options, and get help if you need it. Making smart decisions during this period can help you get the best healthcare for your needs throughout the next year.