IRMAA: What You Need to Know About Income-Related Monthly Adjustment Amount

If you’re on Medicare, you might have heard about “IRMAA,” but don’t let the fancy name confuse you. In this article, we’ll break down what IRMAA is and why it matters for how much you pay for your healthcare.

What is IRMAA?

IRMAA is short for Income-Related Monthly Adjustment Amount. Simply put, it’s an extra cost added to your Medicare premiums based on how much money you make. The idea is that if you earn more, you contribute a bit more to help support the Medicare program.

How Does It Work?

Your income, from two years ago tax return, determines if you have to pay an IRMAA and how much. The government sets income brackets, and if your money falls in a higher bracket, you pay a higher IRMAA.

For example, if your income is above a certain amount, you might pay an extra bit on your regular Medicare Part B and Part D premiums. This helps make sure those who can afford to pay more do so.

Which Parts of Medicare Does IRMAA Affect?

IRMAA mostly impacts Medicare Part B (covering doctor visits and outpatient services) and Medicare Part D (covering prescription drugs). It’s important to know how IRMAA might affect these parts of your Medicare coverage.

IRMAA Tiers and Amounts:

IRMAA is divided into different income tiers, each with its own extra monthly amount. The more you earn, the higher the IRMAA you’ll pay. Understanding the different tiers and amounts helps you know what to expect in your budget.

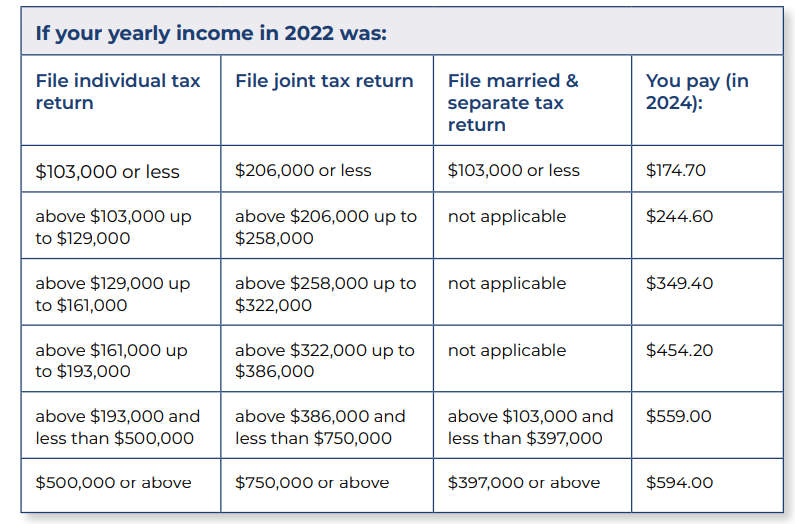

Part B IRMAA: If your modified adjusted gross income as reported on your IRS tax return from

2 years ago is above a certain amount, you’ll pay the standard Part B premium

and an income-related monthly adjustment amount.

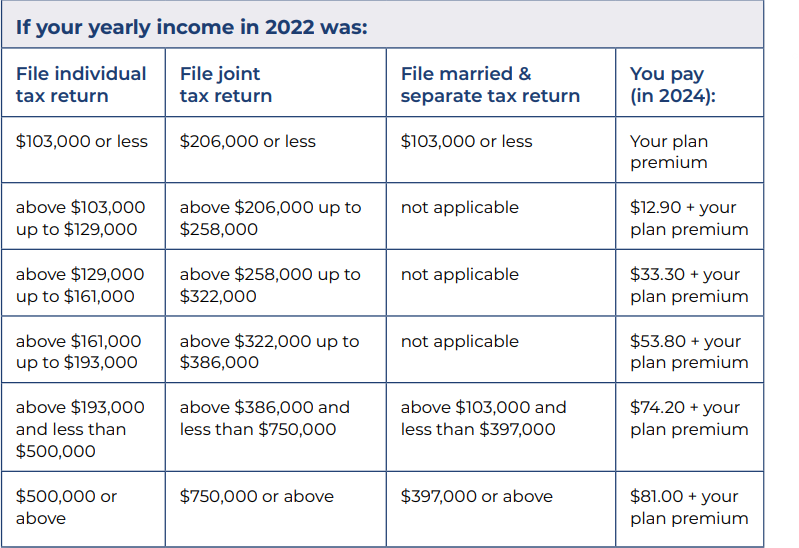

Part D IRMAA: The chart below shows your estimated drug plan monthly premium based on

your income. If your income is above a certain limit, you’ll pay an income-related

monthly adjustment amount in addition to your plan premium.

How to Avoid or Minimize IRMAA:

While some people have to pay IRMAA based on their income, there are ways to manage or lessen its impact. Planning your income carefully, considering certain life events, and knowing the rules about IRMAA can help you handle this part of your Medicare costs better.

Conclusion:

IRMAA might sound complicated, but understanding why it exists and how it works helps you manage your healthcare costs better. By knowing about your Income-Related Monthly Adjustment Amount, you can make smart choices and get the most from your Medicare coverage.