Medigap plans compared: 2024

As we get older, staying healthy becomes very important. In the United States, we have a program called Medicare that helps older people with their healthcare. However, Medicare doesn’t cover everything, and sometimes, you can end up with medical bills you weren’t expecting. That’s where Medigap plans come in. In this blog post, we’re going to take a look at three popular Medigap plans: Plan F, G & N.

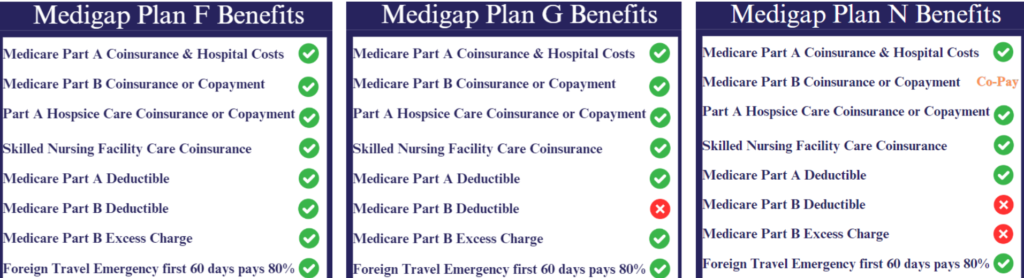

In this comparison, we’re going to break down what Plan F, Plan G, and Plan N cover, how much they cost, and other important things to think about. This way, you can make a smart choice and have confidence in your decision about your healthcare as you get older. So, let’s get started with this simple guide to help you make a wise choice.

What Is Medigap?

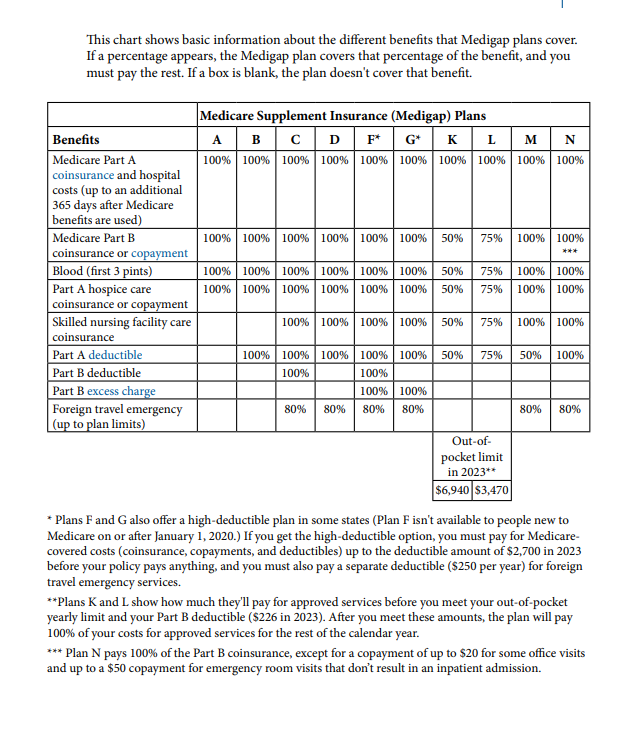

Medigap is a type of health insurance policy that’s designed to fill in the gaps left by Original Medicare . These gaps, also known as “coverage gaps” or “out-of-pocket expenses,” include deductibles, copayments, and coinsurance. Medigap policies are offered by private insurance companies and are meant to work alongside your Medicare coverage.

Medicare covers many of your healthcare needs, but it doesn’t cover everything. For instance, Medicare Part A covers hospital care, but it doesn’t cover all the associated costs. Medicare Part B covers doctor’s visits and outpatient care, but you’ll still have to pay a portion of these expenses. Additionally, Medicare doesn’t cover services like vision, dental, or prescription drugs. That’s where Medigap can help.

Medigap plans are standardized. They offer consistent, predictable benefits.

How Does Medigap Work?

When you have Medigap, it helps pay for some of the healthcare costs that Original Medicare doesn’t cover. For example, if you have a Medigap plan, it can help pay for your Medicare deductibles, copayments, and coinsurance. This means fewer out-of-pocket expenses for you. Medigap policies are standardized in most states, and they are identified by letters (Plan A, Plan B, Plan C, etc.). Each plan offers different coverage options, so you can choose the one that best suits your needs.

Plan F explained

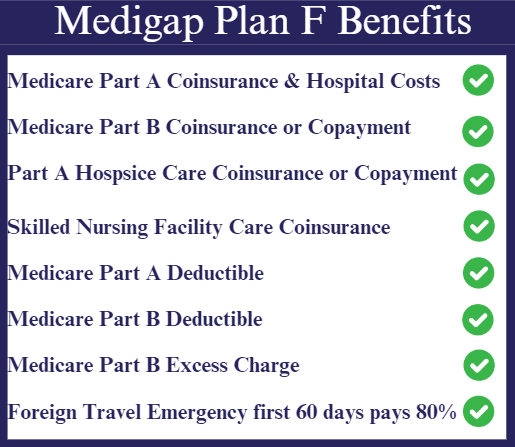

Medigap Plan F is one of the Medicare Supplement plans available to people who are eligible for Medicare. These plans are there to help cover the costs that Medicare doesn’t. Medigap plans, including Plan F, are sold by private insurance companies and work alongside your Medicare.

Medigap Plan F is often known as the most comprehensive option because it covers a wide range of healthcare expenses. With Plan F, you can visit the doctor or hospital without worrying about extra expense. This plan makes your healthcare costs more predictable and less stressful.

Plan F is no longer available for new Medicare enrollees who became eligible on or after January 1, 2020. If you’re already enrolled in Plan F, you can keep it, but new enrollees have other choices like Plan G or Plan N.

Average monthly price for a 65 year old male : $165 per month

Average monthly price for a 65 year old female: $140 per month

(prices can vary drastically depending on your age, sex and where you live, these are simply estimates, call for exact pricing)

Plan G Explained

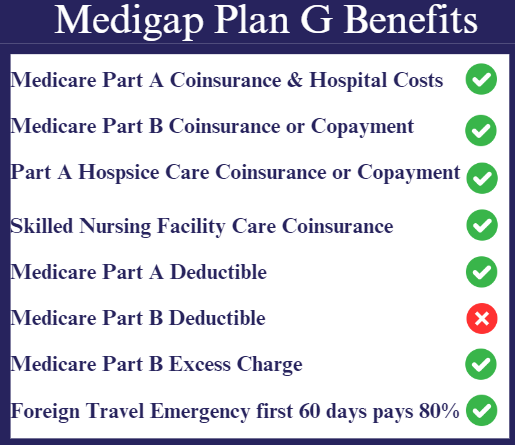

Medigap Plan G, often heralded as one of the most popular and well-rounded Medicare Supplement plans, is designed to bridge the gaps in coverage left by Original Medicare (Medicare Part A and Part B). These Medigap policies are provided by private insurance companies and are meant to complement your existing Medicare benefits.

Medigap Plan G offers comprehensive coverage to help alleviate some of the healthcare expenses that Medicare alone doesn’t cover. The plan G covers every benefit that the plan F covers, except the part B Medicare deductible . In 2023, the part B deductible is $226.

Average monthly price for a 65 year old Male: $130 a month

Average monthly price for a 65 year old Female: $115 per month

(prices can vary drastically depending on your age, sex and where you live, these are simply estimates, call for exact pricing)

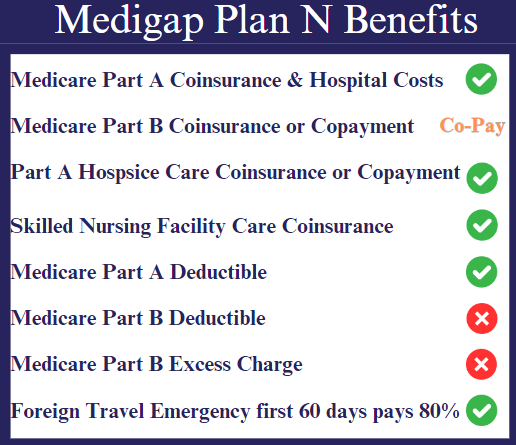

Plan N Explained

Medigap Plan N offers a balanced level of coverage, with some cost-sharing on your part. Here’s a simplified breakdown of what Medigap Plan N typically includes.

Medigap Plan N is a budget-friendly choice that strikes a balance between coverage and costs. It’s an attractive option for those who want to keep their monthly premiums lower while accepting a moderate level of cost-sharing for some services.

Although Plan N may require you to share some costs, the peace of mind it brings, combined with its budget-friendly pricing, can make it a sensible choice for many Medicare beneficiaries.

Average monthly price for a 65 year old Male: $100 per month

Average monthly price for a 65 year old Female: $85 per month

(prices can vary drastically depending on your age, sex and where you live, these are simply estimates, call for exact pricing)

Conclusion and Recommendation

In 2023, if you have a plan F , we recommend to move to a plan G or plan N . Plan F premiums continue to increase much faster than the G or N and will only continue to do so as you age. The only benefit the Plan F covers that is not covered by the Plan G, is the Part B deductible. In 2023. the Part B deductible was $226. If you can save $50 per month , going from F to G ( $600 annually), and only have to pay a $226 deductible , mathematically its a winning equation, or as some would say , a no brainer decision.

If you have a plan G and you do not want to pay any office copays , you should stay where you are at or shop for a better rate for your plan G . However; if you do not mind a small office copay of $20, you may want to shop for a Plan N to realize the monthly savings in premium.

Plan N is most suitable for people who want to save money on monthly premiums and don’t mind a small copay when they go to the doctors office.

No matter what you decide, its important to remember that these plans are “standardized”, so matter who you buy the policy from, a plan G is a plan G, is a plan G . The coverage amongst all Plan G’s are exactly the same (as well as F’s and N’s), the only difference is the monthly premium the insurer charges you.