Supplement Plan N Explained

Medicare is a health insurance program that helps people who are 65 years old or older, people with disabilities, and people with end-stage renal disease. While Medicare covers many medical expenses, it doesn’t cover everything. That’s where Medicare Supplement plans, also known as Medigap plans, come in. These plans help pay for some of the healthcare costs that Medicare doesn’t cover, such as deductibles, copayments, and coinsurance. One of the Medigap plans that many people choose is Medicare Supplement Plan N. In this blog post, we’ll explore what Plan N covers, how much it costs, and who might benefit from it.

What is a Medicare Supplement Plan N?

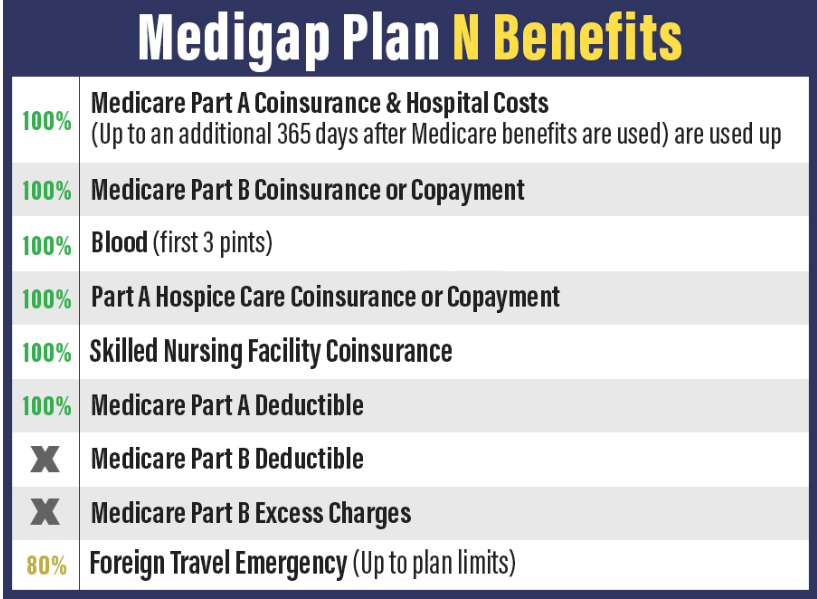

Medicare Supplement Plan N is a Medigap plan that covers many of the healthcare costs that Medicare doesn’t cover. This includes things like deductibles, copayments, and coinsurance. Plan N is one of the most popular Medigap plans because it offers a good balance of coverage and cost. It’s not the most comprehensive plan, but it’s also not the most expensive. Plan N covers the following:

- Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up

- Medicare Part B coinsurance or copayment, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission

- First 3 pints of blood

- Part A hospice care coinsurance or copayment

Plan N does not cover the Medicare Part B deductible, which is $226 in 2023. This means that you will need to pay the deductible before Medicare or Plan N pays for any Part B services. Plan N also does not cover excess charges, which are charges that some doctors and hospitals can bill above the Medicare-approved amount. However, these charges are limited by law in some states.

How much does Medicare Supplement Plan N cost?

The cost of Medicare Supplement Plan N can vary depending on where you live and which insurance company you choose. The cost can also depend on your age and health status. Generally, younger and healthier people will pay less for Plan N than older and less healthy people. Insurance companies can use three different methods to set their prices for Plan N:

- Community-rated: Everyone who has Plan N in your area pays the same premium, regardless of their age or health status.

- Issue-age-rated: Your premium is based on the age you were when you first enrolled in Plan N. The younger you are when you enroll, the lower your premium will be.

- Attained-age-rated: Your premium is based on your current age. As you get older, your premium will increase.

How should I compare Medigap plans?

When comparing Medicare Supplement plans, it’s important to look at more than just the premium. You also need to consider things like the deductible, copayments, and coinsurance that the plan covers. You should also look at the financial strength of the insurance company, as well as any discounts or benefits they offer.

Who might benefit from Medicare Supplement Plan N?

Medicare Supplement Plan N might be a good choice for people who want good coverage at a reasonable cost. It’s not the most comprehensive plan, but it covers many of the healthcare costs that people are likely to encounter. Plan N is also a good choice for people who are willing to pay some of the costs themselves, such as the Part B deductible and the copayments for some office visits and emergency room visits. This can help keep the cost of the plan down.

Plan N might not be a good choice for people who want more comprehensive coverage or who don’t want to pay any out-of-pocket costs. People who live in states where excess charges are common. The bottom line is, if you want to see various plan options and difference prices from hundreds of insurers, all you need to do is find a local insurance broker that you can trust.