Medicare Supplement Plan G

Healthcare is very important for people of all ages. As we get older, we may need more help with our health. That is where Medicare comes in. Medicare is a government program that helps people over 65 pay for medical care. However, sometimes Medicare doesn’t cover everything we need. That is where Medigap plan G also known as Medicare Supplement G comes in.

Medicare Supplement Plan G explained

Medigap or Medicare Supplement, is a kind of insurance that can help pay for things that Medicare does not cover. Medicare supplement Plan G is one type of Medigap plan. It can help pay for things like hospital stays, doctor visits, and other medical services that Medicare doesn’t cover.

To be eligible for Medicare, you must be at least 65 years old or have a disability. If you’re eligible for Medicare, you can enroll in a Medigap Plan G at any time. However, it is best to enroll during your open enrollment period.

Plan G is an excellent choice for people who want more coverage than what Medicare offers. With Plan G, you don’t have to worry about paying for deductibles or copayments for doctor visits or hospital stays. Plan G also covers things like skilled nursing care and emergency medical care when you’re traveling outside of the United States.

When should I buy a Medicare supplement Plan G?

Your Medigap Open Enrollment is a six-month period, you don’t want to miss it. It starts on the first day of the month in which you’re 65 or older and enrolled in Medicare Part B. During this time, you have a guaranteed right to enroll in any Medigap plan, including Plan G, without being denied coverage or charged more because of a pre-existing condition.

If you miss your open enrollment period, you can still enroll in a Medigap Plan G, but you may be subject to medical underwriting. This means that the insurance company can charge you more or deny you coverage based on your health history.

One thing to keep in mind is that you will have to pay a monthly premium for Medigap Plan G. The cost of the premium can vary depending on where you live and other factors. However, many people find that the extra coverage is worth the cost.

What will Plan G cover?

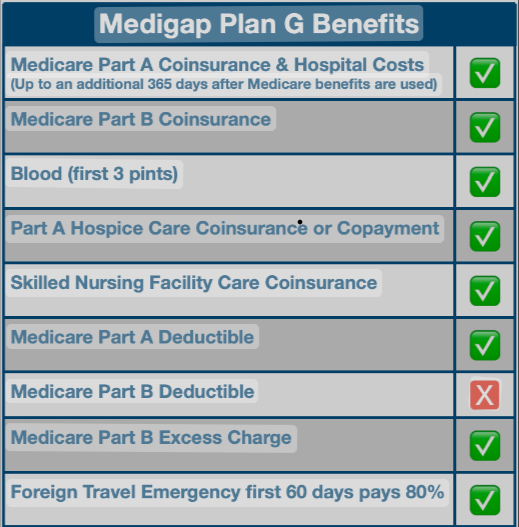

This chart describes exactly what Plan G covers

With Plan G, you don’t have to worry about paying for deductibles or copayments for hospital stays. You do have a yearly $226 Part B deductible. You pay the first $226 for outpatient services and then everything else is paid at 100%. This means that you can go to the doctor or hospital without worrying about the cost after a small yearly deductible.

Plan G also covers things like skilled nursing care and ER when you’re traveling outside of the United States. This means that if you get sick or hurt while traveling abroad, you can still get medical care without having to pay a lot of money.

It’s important to note that Plan G doesn’t cover everything. For example, it doesn’t cover prescription drugs. For prescription drug coverage, you’ll need to enroll in a separate Medicare Part D plan.

Is this a type of Medicare Advantage plan?

Medigap Plan G and Medicare Advantage Plans are two different types of insurance that can help pay for your medical expenses.

Medigap Plan G is a type of insurance that can help pay for things that Medicare doesn’t cove.. It works alongside Original Medicare, which means that you’ll still have Medicare coverage for your medical expenses, but Medigap Plan G will help pay for some of the costs that Medicare doesn’t cover. You can see any doctor or specialist that accepts Medicare, and you don’t need referrals to see specialists. However, Medigap Plan G doesn’t cover prescription drugs, so you’ll need to enroll in a separate Medicare Part D plan for drug coverage.

Medicare Advantage, on the other hand, is a type of insurance that replaces Original Medicare. Instead of having Medicare coverage for your medical expenses, you’ll enroll in a private insurance plan that provides your coverage. Medicare Advantage plans must offer the same benefits as Original Medicare, but they can also offer additional benefits like vision, dental, and prescription drug coverage. You’ll usually need to see doctors within the plan’s network, and you may need referrals to see specialists.

Who should a Medicare Supplement plan G in 2023?

Overall, Medigap Plan G can be a good choice for people who want more coverage than what Medicare offers. It can help pay for things that Medicare doesn’t fully cover, which can be especially helpful if you have a chronic condition or if you’re worried about high medical costs. If you want predicable costs, freedom to go to any doctor who accepts Medicare and most importantly if you can afford the monthly premiums, you may want to strongly consider Plan G. If you work with a licensed broker at LMS, we can shop over 50 different companies to make sure you get the best rate in your area.