Medigap Plans Explained

Medigap plans, also known as Medicare Supplement plans, are healthcare insurance policies that are designed to cover the costs that are not covered by traditional Medicare. These plans are sold by private insurance companies and can be used in conjunction with Original Medicare, which includes Medicare Part A (hospital insurance) and Medicare Part B (medical insurance).

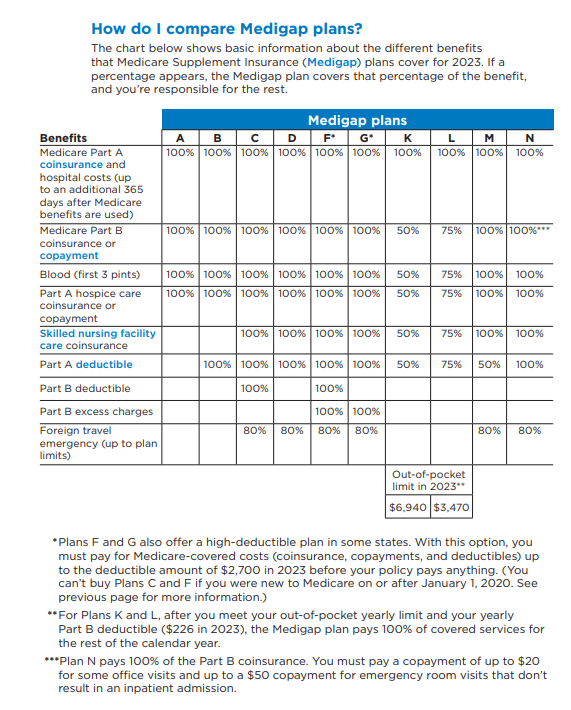

There are ten standardized Medigap plans, labeled with letters from A to N. Each plan has different benefits, and the benefits are standardized across different insurance companies. This means that the benefits of Plan A offered by one insurance company are the same as the benefits of Plan A offered by another insurance company. However, the premiums and other terms of the plans can vary between companies and locations.

In this article, we will go over the various Medigap plans available and what they cover.

Can I choose my own doctors if I buy Medigap?

Medigap plans, also known as Medicare Supplement plans, do not have their own networks. Medigap works alongside Original Medicare and helps cover some of the out-of-pocket costs, such as deductibles, copayments, and coinsurance, that Medicare does not cover.

When you have a Medigap plan, you can generally see any doctor or healthcare provider that accepts Medicare assignment. Medicare assignment means that the provider agrees to accept the Medicare-approved amount as full payment for covered services. So, as long as the provider accepts Medicare assignment, you can see them with your Medigap plan.

The Different Types of Medigap Plans

Medigap chart 2023

Medigap Plan A

The most basic of all the Medigap plans is Medigap Plan A, which covers the following:

- Medicare Part A coinsurance and hospital costs for up to an additional 365 days after Medicare benefits are exhausted.

- Medicare Part B coinsurance or copayment.

- It covers the cost of the first three pints of blood.

This plan does not cover the Medicare Part A deductible, Medicare Part B deductible, or excess charges.

Medigap Plan B

Medigap Plan B covers everything that Plan A covers, as well as the following:

- Medicare Part A deductible

- Skilled nursing facility care coinsurance

- Medicare Part B deductible

This plan does not cover Medicare Part B excess charges.

Medigap Plan C

Medigap Plan C covers everything that Plan B covers, as well as the following:

- Medicare Part B excess charges

- Foreign travel emergency coverage

This plan does not cover the Medicare Part B deductible.

Medigap Plan D

Medigap Plan D covers everything that Plan A covers, as well as the following:

- Medicare Part A deductible

- Skilled nursing facility care coinsurance

- Foreign travel emergency coverage

This plan does not cover Medicare Part B deductible, excess charges, or copayments.

Medigap Plan F

Medigap Plan F is the most comprehensive of all the Medigap plans, and it covers everything that Plans A, B, C, and D cover, as well as the following:

- Medicare Part B deductible

- Medicare Part B excess charges

- Foreign travel emergency coverage

You can no longer buy plan F due to the MACRA law. Those who are eligible for Medicare after January 1, 2020, will not be able to purchase Plan F.

Medigap Plan G

Medigap Plan G covers everything that Plan F covers, except for the Medicare Part B deductible. This plan is becoming increasingly popular as Plan F is being phased out.

Medigap Plan K

Medigap Plan K is a cost-sharing plan that covers 50% of the following:

- Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted

- Medicare Part B coinsurance or copayment

- Blood (first three pints)

- Skilled nursing facility care coinsurance

This plan has an out-of-pocket limit of $6,940 in 2023. Once this limit is reached, the plan will cover 100% of the covered services for the rest of the year.

Medigap Plan L

Plan L provides more limited coverage compared to other Medigap plans, but it also has a lower premium. Specifically, Plan L covers 75% of the following Medicare costs:

- Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted

- Medicare Part B coinsurance or copayment

- First three pints of blood for a medical procedure

- Hospice care coinsurance or copayment

After you have met the yearly out-of-pocket limit ($3,470 in 2023), the plan will pay for 100% of the Medicare-covered costs for the remainder of the year.

Medigap Plan M

Plan M offers a moderate level of coverage that can help reduce some of the expenses that Medicare beneficiaries might incur. Some of the benefits covered under Plan M include:

- Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted

- Medicare Part B coinsurance or copayment

- Blood (first 3 pints)

- Hospice care coinsurance or copayment

- Skilled Nursing Facility care coinsurance

Plan M won’t cover your Part B deductible or any excess charges that may be charged by doctors who do not accept Medicare assignment.

Plan N

Plan N covers some of the out-of-pocket costs that Original Medicare does not pay for. Here’s what Medigap Plan N typically covers:

- Plan N covers your Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted.

- Plan N covers the Part B coinsurance or copayment, which is typically 20% of the Medicare-approved amount for most medical services.

- Plan N covers the first three pints of blood that you need for a medical procedure.

- Plan N covers the coinsurance or copayment for hospice care that is not covered by Medicare Part A.

- Plan N covers the coinsurance for SNF care that is not covered by Medicare Part A.

- Plan N does not cover the Part A deductible, which is $1,600 in 2023.

- Plan N does not cover the Part B deductible, which is $226 in 2023.

- Plan N does not cover Part B excess charges, which are additional charges that some doctors and providers may charge beyond the Medicare-approved amounts

How much does this type of coverage cost?

The cost of Medigap plans can vary depending on several factors such as the plan type, location, age, gender, and health status of the individual enrolling.

In general, the monthly premiums for Medigap plans can range from around $50 to $300, with some plans costing more than others due to their coverage levels. Plan F and Plan G, for example, tend to have higher premiums because they offer more comprehensive coverage. The price of the plans is going to vary between insurers. Additionally, some insurers may offer discounts or promotional rates that can lower the monthly premiums.

You should work with a licensed insurance advisor so you can see all of the rates in your area.