Medicare’s “Donut Hole” : The Coverage Gap explained

Medicare, the government’s health insurance program for older adults, helps millions of people afford healthcare services. But within Medicare, there’s a part of the drug program called Medicare’s “donut hole” that can be confusing. Let’s explore this coverage gap in more detail to help you understand how it works and how it affects you.

Medicare Part D is the part of Medicare that helps cover prescription drugs. But within Part D, there’s a phase called the “donut hole.”, also referred to as “the coverage gap”. This happens when your drug costs reach a certain limit, and you have to pay more for your medications for a while.

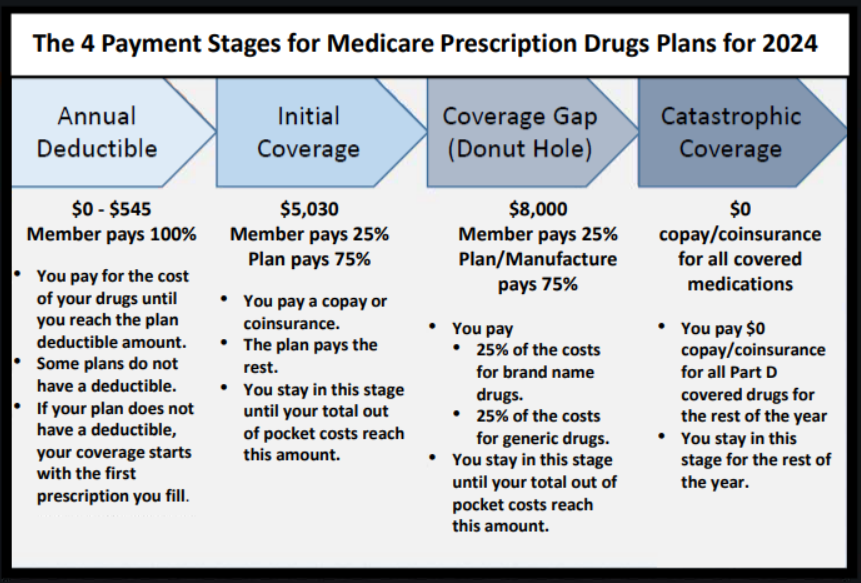

Four Phases: Deductible, Initial Coverage, Donut Hole, and Catastrophic Coverage

- Deductible : A prescription drug deductible is the amount you pay for drugs before your part D plan pays its share. Not all Part D plans have a deductible.

- Initial Coverage Phase: At first, you pay a certain amount for your prescriptions until you reach a limit. You will a have a fixed cost for each prescription. For example: a tier 1 drug may have a $0 copay, a tier 2 drug may have a $10 copay, tier 3 $47 and so on.

- Donut Hole: During this phase, you have to pay a higher percentage of your drug costs. It can be challenging because your expenses go up. You reach this phase, once you and your drug plan have paid $5,030 in drugs costs in the calendar year. While in this stage, you will pay 25% of the cost of Part D brand name medications. The drug manufacturer pays 70% of the cost of Part D brand name medications and your Part D plan pays the remaining 5%. The entire cost of the Part D brand name drug, minus the 5% that your plan pays is responsible, goes toward your out-of-pocket maximum of $8,000.

- Catastrophic Coverage Phase: You enter the Catastrophic Coverage stage when your total out-of-pocket costs (what you pay PLUS what the drug manufacturer pays) reach $8,000. While in Catastrophic Coverage, you pay nothing for covered Part D drugs and for excluded drugs that are covered under our enhanced benefit.

Changes Over Time

In 2010, a law called the Affordable Care Act (ACA) aimed to help with the donut hole. It made some improvements, but the gap hasn’t disappeared completely.

In 2023, the inflation reduction act was passed. This has major implications on Part D drug coverage. This bill has the following provisions:

- Insulin available at $35/month per covered prescription

- Access to adult vaccines without cost-sharing

- A yearly cap ($2,000 in 2025) on out-of-pocket prescription drug costs in Medicare

- Expansion of the low-income subsidy program (LIS or “Extra Help”) under Medicare Part D to 150% of the federal poverty level starting in 2024

How Does the Donut Hole Impact You?

The donut hole can make it hard to afford your medications. Some people might skip doses or not fill their prescriptions because of the cost. This can lead to health problems if you don’t take your medicines as prescribed.

Tips for Managing Medicare Costs

To make it easier for you, it’s essential to review your Medicare plan each year during the open enrollment period. You can switch plans if needed to find one that better fits your needs and budget. Additionally, programs like Extra Help provide financial assistance for prescription drug costs for those with limited income and resources.

Conclusion: Navigating Medicare’s Complexities

Understanding Medicare’s “donut hole” is crucial for making informed healthcare decisions. While progress has been made to address this coverage gap, there’s still work to be done. By staying informed, utilizing available resources, and advocating for improvements, you can navigate Medicare’s complexities and ensure access to affordable prescription medications.