Part C Coverage Out of State

Medicare Advantage plans, also known as Part C, are like a bundled-up version of Original Medicare. They give you hospital and medical insurance together, often with extra benefits like drug coverage or dental care. But what about when you’re away from home? Most people are confused by Part C coverage out of state. Let’s dig into what happens with these plans when you travel.

What’s Part C Medicare Advantage?

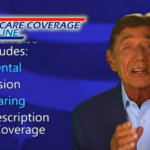

Medicare Advantage plans combine the benefits of Medicare Parts A and B, but they’re run by private insurance companies, not the government. These plans cover a range of health services, like hospital stays and doctor visits, and sometimes even extras like prescription drugs and dental care. It’s like having all your healthcare needs taken care of in one package. This makes managing your health easier because everything is in one place, making it simpler to keep track of and get the care you need.

Part C Coverage Out of State

When it comes to being away from home, there are some key things to know about your Medicare Advantage plan. Whether you are on a week vacation or just spending a day in a neighboring state, you still want the peace of mind of knowing you are covered. There are limitations to routine services out of state, but for emergencies, you are covered anywhere in the US on a Part C plan.

Emergency Care Anywhere

If you have a serious medical emergency, like a heart attack or a bad accident, your plan will likely cover you even if you’re outside your normal coverage area. This means you can get urgent help without worrying about costs, no matter where you are in the U.S. You typically would pay the same “co-pay” no matter where you are . You always have Part C coverage out of state in an emergency.

Let me give you an example . In Ohio, a lot of Part C plans charge around $3o0 per day in the hospital. If you are in a hospital for 3 days, you would be responsible for roughly $900 ($300 X 3 days). Now imagine you are in Florida for a 2 week trip. You suddenly feel light headed and need rushed to the hospital. As long as its an “emergency” , your Part C plan should charge you the same exact copay . No matter what hospital your taken to, your responsibility should still be around $300 per day.

Urgent Care Coverage

In times of urgency, like when you suddenly get sick or hurt but it’s not super serious, Medicare Advantage plans often help cover the cost of urgent care even if you’re away from home. This means you can go to an urgent care center to get help. These places can treat a range of health issues, from small injuries to sudden sickness. It’s nice to know that even when you’re traveling or staying somewhere different, your Medicare Advantage plan is there to support you. This coverage gives you peace of mind and ensures you can get the care you need without worrying too much about money, no matter where you are.

Limits on Routine Care

For regular doctor visits or other non-emergency care, there might be some limits. Your plan usually works with a network of doctors and hospitals, and if you see someone out of that network, it might cost you more or not be covered at all. But in an emergency, you should always get the help you need, no matter where you are. There are now certain plans that will cover routine services out of state. Because there are so many different options, call an expert to find out what your choices are.

Tips for Travelers:

If you’re someone who travels a lot or spends time in different places, it’s smart to check if your plan offers any extra benefits for travelers. Some plans might give you special coverage for trips or longer stays away from home, which could be really helpful.

Wrapping Up

Understanding how your Medicare Advantage plan works when you’re away from home can give you peace of mind. Knowing that Part C coverage out of state is there, means you can focus on enjoying your travels without worrying about your health coverage. So, whether you’re exploring new places or just visiting family, it’s good to know your Medicare plan has your back, wherever you go.